SMM March 28 News:

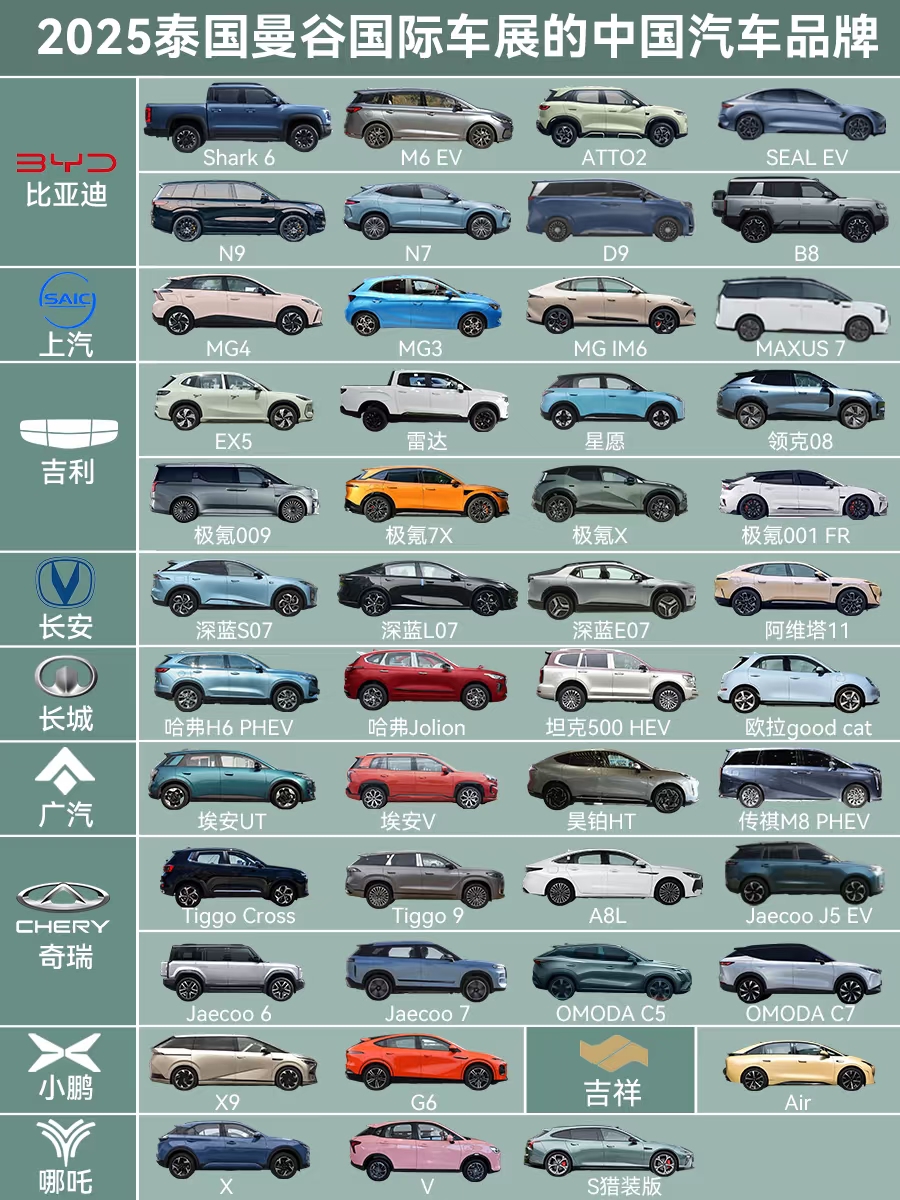

On March 26, the 46th Bangkok International Motor Show opened in Thailand, attracting 41 automakers from Europe and Asia. Among them, 16 Chinese car brands made a collective appearance. Chinese automakers have jointly entered the Thai market, posing a significant challenge to the near-monopoly of Japanese cars in Thailand. The Bangkok Motor Show is the largest auto show in Southeast Asia and the second largest in Asia, holding great significance for the global strategy of Chinese automakers.

From the spectacle of the 2025 Thailand Motor Show, the global strategy of Chinese automakers is leveraging Thailand as a pivot, driving through "technology export + localized deep cultivation" to compete comprehensively with Japanese automakers in the Southeast Asian market. This strategic choice is based on a precise judgment of Thailand's status as the "ASEAN automotive hub" and reflects the unique advantages of Chinese automakers in electrification, supply chain, and policy synergy.

I. Why Choose Thailand as the First Stop?

Policy Dividends and Market Potential

The Thai government has introduced the "30•30" policy (30% zero-emission vehicles by 2030) and EV3.5 incentives (car purchase subsidies, tariff reductions, etc. from 2024-2027), providing tax benefits and subsidy support for Chinese automakers, such as a maximum subsidy of 100,000 baht (approximately 20,000 yuan) per EV. The penetration rate of new energy vehicles in Thailand reached 12% in 2025, and after surpassing the critical point of 10%, the market is expected to enter a period of explosive growth, indicating huge market potential.

Industry Chain and Geographical Advantages

Thailand boasts the most mature automotive supply chain in Southeast Asia, with over 700 component suppliers and 500,000 employees, earning it the title of "Asia's Detroit," facilitating rapid factory construction and cost reduction for automakers.

Its geographical location connects the ASEAN market, and through the RCEP agreement, it can reach a population of 660 million, allowing exports to Australia, the Middle East, and other regions without additional tariffs.

Substitution Opportunities Under Japanese Dominance

Japanese cars have long held over 70% of the Thai market share, but their slow transition to electrification provides an opening for Chinese automakers. In 2024, the market share of Japanese cars dropped to 78%, while Chinese brands increased from 5% to 11%.

II. Core Advantages of Chinese Automakers

Leading Electrification Technology and Cost Advantages

Chinese new energy vehicles significantly outperform Japanese internal combustion engine vehicles in battery technology, intelligent configurations (such as external discharge function), and driving range. For example, BYD Dolphin and GAC Aion models are favored by Thai consumers for their economy and functionality.

Rapid Localization Response Capability

Chinese automakers are accelerating factory construction in Thailand, such as BYD (annual capacity of 150,000 units), GAC Aion (50,000 units), and Great Wall (80,000 units), and have committed to using 40% local components, meeting Thailand's supply chain localization requirements.

They have launched right-hand drive models and pickup trucks and MPVs tailored to Southeast Asian needs, precisely matching market preferences. Recent developments at the Thailand Motor Show show that Chinese brands have successively introduced pickup truck product lines adapted to Southeast Asia.

Ecological Layout and Brand Synergy

Chinese automakers are not only focusing on production but also building charging networks (e.g., GAC plans to build 200 supercharging stations in Thailand by 2027), battery repair centers, and mobility services (e.g., cooperation with Grab), creating a full life cycle service ecosystem.

By acquiring overseas brands (e.g., MG, Volvo) or partnering with local dealers, they are quickly establishing channels and after-sales systems, addressing brand recognition shortcomings.

III. Challenges and Paths to Surpass

Countering the Counterattack of Japanese Automakers

Japanese brands are consolidating the market through financial tools (zero down payment loans, used car value retention strategies) and leveraging political influence to pressure Chinese automakers to raise prices. Chinese automakers need to strengthen local financial service capabilities, such as collaborating with Thai banks to develop flexible loan solutions.

Avoiding the "Price War Trap"

Thai consumers are price-sensitive, but excessive price reductions may trigger disputes over used car depreciation (e.g., complaints caused by BYD ATTO3 price cuts). It is necessary to balance market expansion and brand value. Additionally, product image needs to be enhanced. Japanese cars have dominated the Thai market for decades, thanks to long-term product image promotion and cultural output. Not just cars, but other Japanese brands also reflect this, from cars to daily necessities, Japanese brands are synonymous with "high quality," "leading," and "high-end" in the minds of Thais. Chinese brands going global need to break this bias and establish a better brand image. Rome wasn't built in a day, and neither is brand image, which requires long-term accumulation and the test of time. To avoid repeating the failure of Chinese motorcycles, quality must be prioritized, and brand image must not be damaged by low-price competition.

Long-term Cultivation and Cultural Integration

Japanese automakers have been operating in Thailand for decades, with channels penetrating into townships. China needs to strengthen local talent cultivation and cultural adaptation, such as differences in workplace habits. The overtime and cut-throat competition in Chinese workplaces do not align with the "jai yan yan" behavior of Thais.

The competition of Chinese automakers in the Southeast Asian market is essentially a contest between two development models: Japanese automakers rely on the inertia of the internal combustion engine era's supply chain, while Chinese automakers are rewriting the rules of the game with the advantages of electrification technology revolution and policy synergy. From the Thailand Motor Show, Chinese automakers have established advantages in product, price, and ecology, but to achieve comprehensive surpassing of Japanese automakers, breakthroughs in technical standards, brand value, and localization depth are still needed. In the future, it is necessary to further deepen the localization strategy, build a complete ecosystem from production to service, and balance price competition and brand value to achieve the leap from "substitute" to "leader" in the Southeast Asian market. In the next five years, Southeast Asia may become the "testing ground" for the globalization of the Chinese automotive industry, and its experience will provide important references for entering the European and US markets.

SMM New Energy Research Team

Cong Wang 021-51666838

Rui Ma 021-51595780

Disheng Feng 021-51666714

Yanlin Lyu 021-20707875